Contributions and Political Receipts

Entering Contributions

After choosing a individual, PAC/Company or Vendor from the main screen, click on the Receipts button. You'll then see the receipt entry window, with all of the account's prior entries, if any, displayed on a grid.

To edit a prior entry, double-click on the entry and it will appear with all its details in the lower part of the window.

To add a new entry, you must first choose a code. Either enter the code or click on the description to look it up. Once you've entered the code or description, click on the amount field. You will notice that a number of defaults are automatically entered: the description, today's date, receipt type, form, political categories and account. These are the defaults that have been established in the committee setup section of the program.

Any of these defaults can be overwritten. For example, to change the description, click on the Desc button and enter something other than the default.

Political Receipts

If you're managing a political committee or PAC, here are some pointers for handling some of the trickier forms of political receipts so they will properly appear on your disclosure report.

Receipt Types

In most cases the Type field will default to PC for Political Contribution. Here are the other types that can be entered:

TI Transfer from other Cmtes

MR Monetary Receipt

RD Redesignation

EA Earmarked Donation

PL Pledge

PS Partnership Share

CT Conduit

LO Loan

FL Forgiven Loan

IK In-Kind

3P Third Party Payment

TK Ticket Purchase

DB Debt

RF Refund

IN Interest

OT Other

In-Kind receipts

Enter IK for the Type. Then, in the comment section, enter the description of the in-kind receipt. Do not enter an offsetting disbursement; the system will account for the offsetting disbursement when the FEC report is run.

Default Election Period

When you enter political receipts, the default election period, which usually begins with P or G (ex: G2012 or P2014), will appear in the lower-right area of the entry screen. In 99 percent of cases the code is related to the date entered, so you should accept the default. At the beginning of each election cycle you'll need to change the default:

1. Go to Data File Maintenance->Support Codes->Election Period codes. Enter the election period. If it doesn't appear, click on New Code and add it.

2. Go to Setup->Program->Committee. Enter the code under the Accounting tab, in the space marked Default Election Period. Then click Save.

Redesignations

A redesignation occurs when you redesignate a contribution from one election period to another.

For example, you receive a check for $2,000 from a contributor who's already given $1,000 for the current election period. This brings his aggregate contributions for the current election period to $3,000. Since the 2021-2022 federal limit is $2,900, you'll need to redesignate $100 to a future election period.

It is done in three donations:

1. The original donation, marked as a check, with the Type recorded as PC (Political Contribution).

2. A negative donation for the amount of the redesignation. The Type is recorded as RD (Redesignation).

3. A final donation for the amount redesignated. The Type is recorded as RD (Redesignation) and the Election Period should be code for the period to which the amount is redesignated.

The code and date should be the same on all three donations. Here's an example:

| Code | Description | Date | Form | Amount | Type | Period |

|---|---|---|---|---|---|---|

| GEN | General Contribution | 04/15/2022 | Check | 2000.00 | PC | P2022 |

| GEN | General Contribution | 04/15/2022 | -100.00 | RD | P2022 | |

| GEN | General Contribution | 04/15/2022 | 100.00 | RD | G2022 |

Reattributions

To enter reattributions of over-the-limit donations, do the following:

1. Make sure the individual to whom a portion of the check is to be reattributed (usually a spouse) is entered in your master file. In the Related Person section, enter the name of the original donor.

2. Enter the full amount of the check. You'll probably receive an overlimit warning. Click through it.

3. Click on the Reattribution button. Look up the name/file of the person to whom a portion of the check is to be reattributed, and enter the amount.

When you run your FEC report, the full amount of the check will be reported, with the reattribution as a memo entry.

Partnerships

To enter receipts from a partnership, do the following:

1. Enter the partnership in the PAC/Company section. On the second tab (Email/Political) the Entity Type should be Partnership.

2. Enter all partners as individuals with their names and addresses, just as you would any other contributor.

3. Enter the partnership check. Call up the PAC record established for the partnership, and go to Receipts. When you enter the receipt, make sure the Type is PC for Political Contribution. If yours is a federal committee, the Line Number will default to "11AI" (Schedule A, Line 11a).

4. Enter the individual contributors. Click the Partners button and enter each partner's share in the window that appears. If you don't see the partnership button, then the PAC record hasn't been saved with an Entity Type of Partnership.

When you revisit the contribution screen, you'll see the prompt (above in blue) reminding you of the partnership split. Click the Partners button to view them.

When you run your FEC report, each individual contributor will be listed as a memorandum entry under the partnership's receipt.

Joint Fund-Raisers

To enter receipts from a joint fund-raising event, do the following:

1. You must first establish the Fundraising Representative, i.e. the committee that collects and distributes the money. The receipts from the joint-fund-raiser will be entered as receipts from this committee. Enter the committee as a PAC.

2. Establish a contribution code for the fund-raising event. When you enter the contribution code and check the Joint Fundraiser box, you can then fill in the Fundraising Representative.

3. Call up the PAC record established for the Fundraising Representative, and go to Receipts. When you enter the receipt, make sure the Type is "TI" for Transfer. If yours is a federal committee, the Line Number will default to "12" (Schedule A, Line 12).

4.Enter the individual contributors as memo entries. Click on the Memo button and enter each memorandum entry in the window that appears. Enter "Joint Fundraiser" in the Comment section for each.

When you run your FEC report, each individual contributor will be listed as a memorandum entry under the Fundraising Representative's receipt. "Joint Fundraiser" will appear in the comments section of both the original donation and the memo entries.

Loans

To enter a CANDIDATE LOAN, do the following:

1. Enter the loan as a receipt. Make sure the Type is LO for LOAN. If yours is a Federal committee, the FEC Line Number should be 13A.

2. Look in the lower-right corner of the entry window. You'll see a button marked Loan Info. Click there and fill out the screen. The DUE DATE should be "on demand", the INTEREST RATE should be "none" and CANDIDATE'S PERSONAL FUNDS should be checked. (If you don't see the Candidate's Personal Funds checkbox, it's because the line number wasn't marked as 13A.)

3. Re-generate your FEC report. Validate it and then click on FEC Print. Go to the very bottom and you'll see the schedule with the loan info printed out.

Earmarked Contributions

To enter an earmarked contribution, do the following:

1. Enter the total amount of the earmarked contribution as a receipt. Make sure the Type is EA for Earmarked.

2. Look in the lower-right corner of the entry window. You'll see a button marked "Earmarks". Click there and enter each contribution that's included in the earmarked bundle.

3. Click Save to return to the contribution entry window.

When you generate a Daily Cash Report, each individual check will print out rather than the entry you originally marked as the Earmarked donation. That is because it's the individual checks that are deposited into your account, and not the "dummy" donation that you report to your state or Federal filing authority.

Refunds and returns

Normally these are entered as receipts and not negative disbursements. Most jurisdictions have a Form, Schedule or Line Number for Refunds and/or Returns. (For Federal candidates, it's Line 14.) Many jurisdictions require a link between the refund and the original contribution, with an appropriate update to the recipient's aggregated totals.

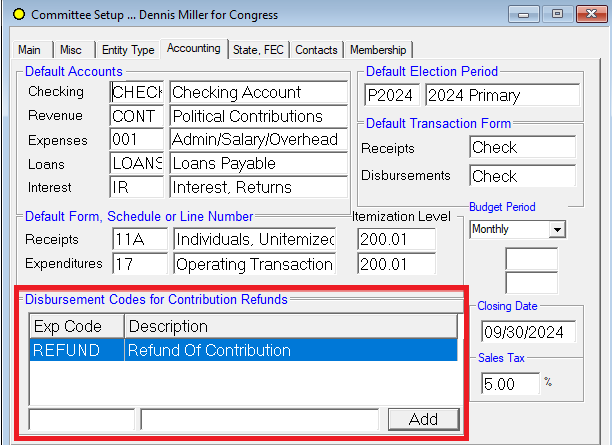

The first step is to establish the disbursement code to be used for refunds.

When you save this screen, the disbursement code on the first line will also be saved as a receipt code.

Then enter the receipt, using this code. There's no link to an actual disbursement, so if the receipt is a reimbursement of a contribution made by the committee, it's best to enter something like "Refund of March 23 contribution" in the comment line.